Tata Power: All right elements to become a leader in Power Sectorby: WR Team

CXO Quotes

“To streamline our renewable business, we are consolidating all renewable companies under Tata Power Renewable Energy Ltd. (TPREL) platform. While some subsidiaries will remain for capital projects, the majority will be integrated into TPREL. This strategic move will ensure efficient management and operation of our renewable business, promoting synergy and cohesion while leveraging the benefits of a unified platform” - DR. PRAVEER SINHA CEO & MD, The Tata Power Company Limited

Renewable Energy Landscape in India

Latest data is not accessible. India aims to reach net zero emissions by 2070 and meet 50% of its electricity requirements from renewable energy sources by 2030. The Indian government is continuing to promote the use of renewable energy sources as part of its goal to achieve 500 GW of non-fossil electricity capacity by 2030, with installed generation capacity standing at 416 GW in FY23.

Tata Power's Contribution to Renewable Energy

Tata Power will be a major contributor to India's renewable energy goals. The company is planning to generate 15 gigawatts of renewable capacity by 2027. The company has signed two major MoUs with Gujarat and Tamil Nadu. In Gujarat State, the company will invest ₹70,000 crores, and in Tamil Nadu State, ₹70,800 crores. The company’s greenfield 4 GW manufacturing facility will become operational in Q4 – FY24.

Capital Infusion Initiatives

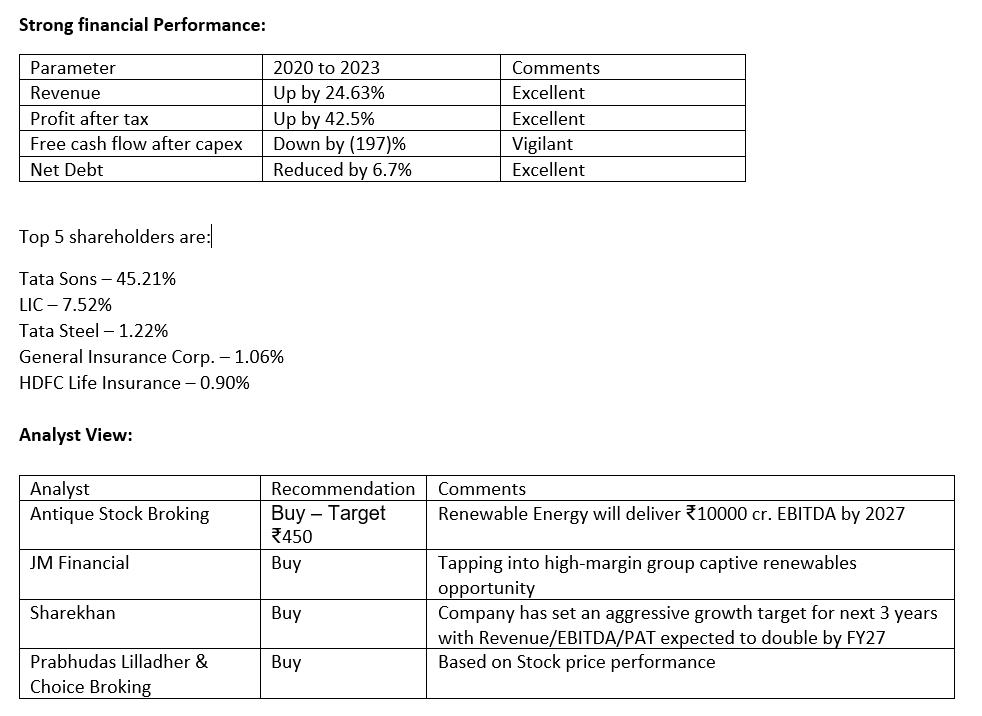

The Company has invested ₹29,500 crores in renewable energy projects. In 2023, the company made 73% of Capex financed through internal accruals and invested ₹4,000 crores in capital infusion into the renewable business by external investors BlackRock and Mubadala. In FY24, the company plans to fund its capex of over ₹12,000 crores primarily from internal accruals.

Debt Reduction and Loan Options

Tata Power adopted debt-light models through innovative financial engineering and restructuring. Also, favorable legal orders in Andhra Pradesh and government notifications on EMI payments for outstanding dues have helped Tata Power reduce its debt.

Indian companies commonly rely on external commercial borrowing (ECBs) as their primary means of securing financial support from lenders based overseas. Tata Power secured $320 million in sustainability-related loans from Bank of America (2022). The company has received a ₹450 crore "sustainable trade finance facility" from MUFG Bank of Japan to fund its solar projects in Maharashtra and Gujarat in FY23. In September 2023, the company secured $425 million in financing from the US International Development Finance Corporation (DFC) for the newly signed MoU on the Tamil Nadu project.

Government Initiatives

- PFC and REC have reduced their lending rate to 8.25%, boosting renewable energy.

- 100% Foreign Direct Investment (FDI) is permitted under the automatic route without any prior government approval, allowing foreign firms to own entire power projects.

In Conclusion

India is actively exploring the fastest-growing renewable energy market, which will help Tata Power grow, and these investments will contribute to achieving net-zero goals.

For more information, visit Walls Research and subscribe to the latest insights on Twitter.